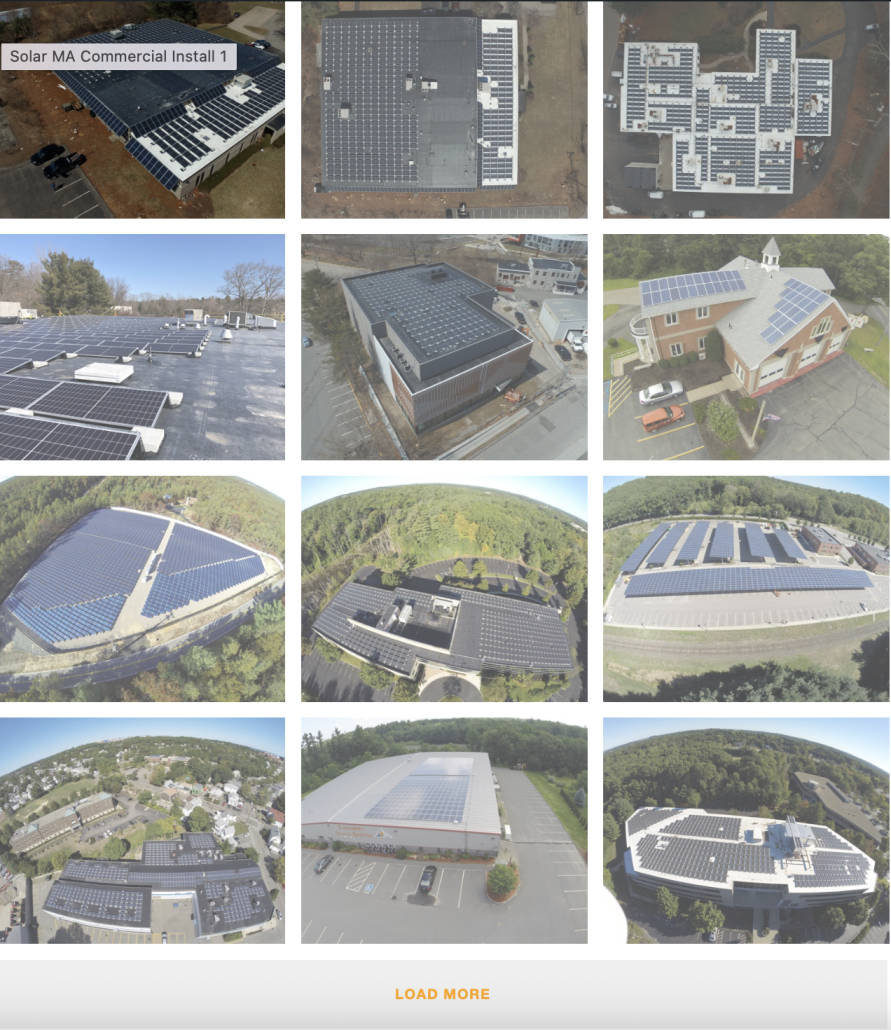

Commercial Solar in 2023

Going Solar in 2023

We’ve never seen anything like it. The Inflation Reduction Act has enacted Federal Tax Credits for Solar that increase previous amounts by 100% in some cases.

Many of our clients are enjoying 50% tax credits. When combined with depreciation, those tax credits result in tax shields covering 75% of a system’s cost.

The Dept of the Treasury has released guidance on the tax credits and various adders that create the pathway to retaining these tax credits

Call or email us now to set up your no-cost consultation and see if your site can capitalize on this once-in-a-lifetime opportunity.

Unprecedented Tax Breaks

The investment Tax Credit has been increased from 26% to 30%, and may now be transferred or sold to other taxpayers. The 30% applies to both business and residential projects, including projects installed in 2023, and will last until the end of 2032.

Energy storage projects were previously ineligible for tax credits unless they were connected directly to solar power projects. The Inflation Reduction Act removes these requirements and allows energy storage projects to receive the same 30% tax credit, even if they are stand-alone facilities. Batteries connected to a solar power project will continue to qualify for the credit, even if they are no longer being charged by solar power.

Interconnection costs will also be included in the tax credit, for projects smaller than 5 MWac.

- Domestic content – 10% tax credit adder

- Project siting – 10% tax credit adder

- Clean electricity production credit

- 60% tax credit opportunity?