Take the First Step Towards Solar Savings

In the heart of New England, Massachusetts offers more than just rich history and beautiful landscapes—it also presents a prime opportunity to harness the power of the sun through solar energy. With its commitment to renewable energy and supportive policies, Massachusetts has become a beacon for homeowners looking to save money while reducing their carbon footprint.

Why Go Solar in Massachusetts?

- Financial Incentives: Massachusetts offers robust financial incentives to homeowners who install solar panels. These incentives include Renewable Energy Credits (RECs), which can be sold for extra income, and the Residential Renewable Energy Income Tax Credit, allowing you to deduct a portion of the installation costs from your state income taxes.

- Net Metering: The state’s net metering policy allows homeowners to receive credits on their utility bills for the excess electricity their solar panels generate and send back to the grid. This means you can effectively reduce or even eliminate your electricity bills.

- Environmental Impact: By generating clean, renewable energy from the sun, you can significantly reduce your household’s carbon footprint. This is a tangible way to contribute to a healthier environment for future generations.

Why Choose Our Solar Experts?

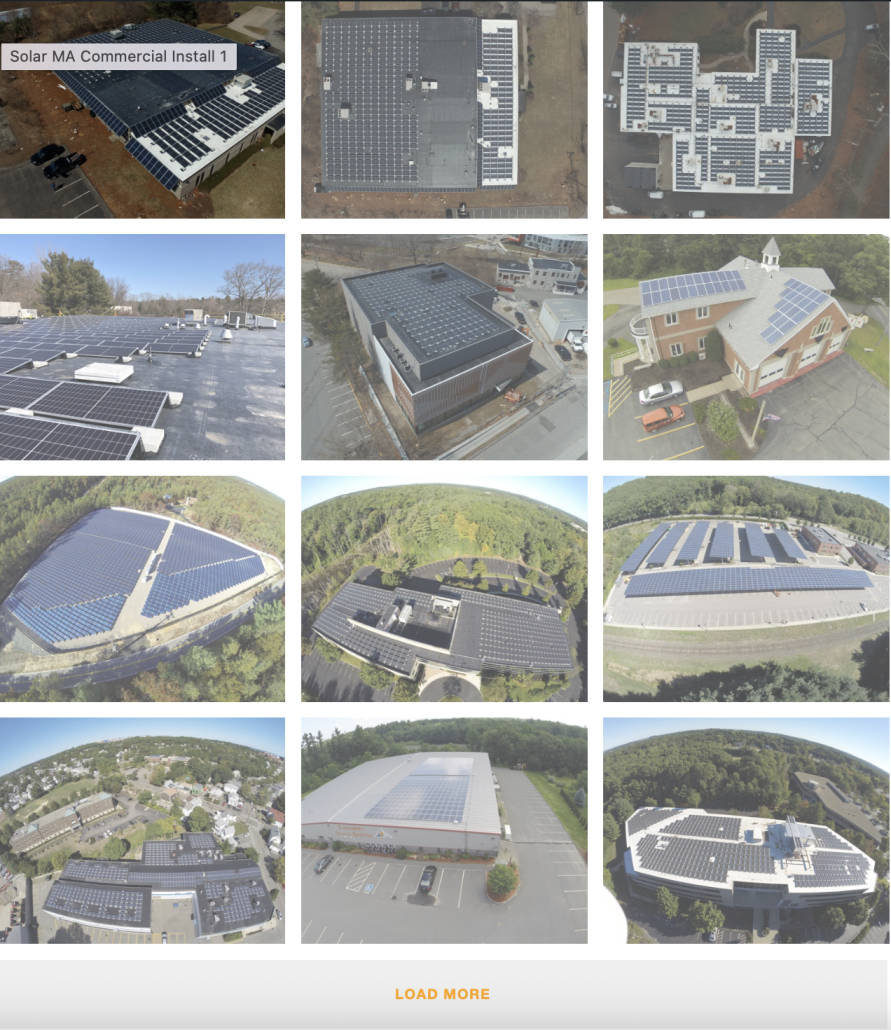

At SGE Solar, we specialize in helping Massachusetts, Rhode Island, & New Hampshire homeowners & businesses make the switch to solar power seamlessly. Here’s how our solar experts can assist you:

- Free Solar Quote: We offer a no-obligation solar quote that outlines how much you can save by switching to solar. Our experts will assess your home’s energy needs, roof orientation, and other factors to provide you with a personalized savings estimate.

- Customized Solutions: Every home is unique, and our team understands that. We tailor solar solutions to fit your specific energy goals and budget, ensuring maximum efficiency and savings.

- Expert Guidance: From initial consultation to post-installation support, our knowledgeable team will guide you through every step of the process. We handle paperwork, permits, and inspections, making the transition to solar stress-free for you.

Take the First Step Towards Solar Savings

Now is the perfect time to take advantage of Massachusetts’ solar incentives and make the switch to clean, renewable energy. Contact us today to schedule your free solar quote! Let our experts show you how much you can save—and how easy it can be to go solar!

Join the thousands of Massachusetts homeowners who are already enjoying the benefits of solar energy. Make the environmentally responsible choice that also saves you money in the long run. Together, we can create a brighter, cleaner future for our communities.