SGE Solar: Delivering Better Value Than Ever in 2026—Even Without the Tax Credit

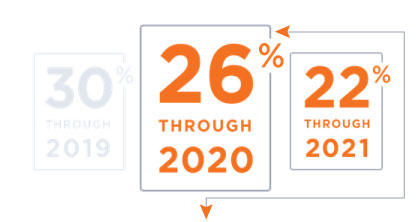

As we move into 2026, many homeowners are wondering whether solar is still a smart investment—especially with some federal solar tax credits starting to phase out for residential customers. At Second Generation Energy SGE Solar, the answer is a resounding yes.

Thanks to lower pricing, improved technology, and strategic installation planning, SGE Solar continues to offer a value-packed solar solution that more than makes up for any reduced tax incentives. We’re proud to help homeowners and businesses across Massachusetts, Rhode Island, and New Hampshire save money and switch to clean energy—even in a changing incentive landscape.

What’s Changed—and Why Solar Still Makes Sense

While the federal residential solar tax credit has begun to wind down, SGE Solar has responded by offering even more competitive pricing, ensuring that going solar remains a smart financial decision in 2026 and beyond.

Lower equipment costs, better financing options, and our commitment to efficiency help you see real savings, faster.

✅ Lower 2025 Pricing

✅ Fast ROI with No Upfront Cost Options

✅ Top-Tier Panels & Local Expertise

✅ Custom Residential and Commercial Solar Solutions

Commercial Solar? The Tax Credit Is Still On

For businesses thinking about going green, there’s even better news: the commercial solar tax credit continues, making now the ideal time to invest in sustainable energy for your facility.

Whether you’re running a small business or managing a large commercial property, SGE Solar has the expertise to deliver cost-effective, reliable solar solutions tailored to your energy needs.

Get a Free Solar Quote Today

At SGE Solar, we’ve helped thousands of customers take control of their energy bills while doing something good for the planet. We make it easy—with free quotes, clear guidance, and full-service solar installation from start to finish.

📍 Serving all of Massachusetts, Rhode Island, and New Hampshire

🏢 Residential, Commercial, Small Business, and More

📞 Contact Second Generation Solar today to see how much you can save.

Ready to Switch? Let’s Talk Solar.

Fill out our quick quote form or give us a call, and we’ll show you how SGE Solar can help you take advantage of 2025’s best solar value—with or without the tax credit.